Get facts, stats, and case studies about the shifts happening within District boundaries with the North Houston Commercial Real Estate Market Report.

Stay ahead with the North Houston District’s Commercial Real Estate Market Reports, expertly crafted by Robert Fiederlein, our Vice President of Planning and Infrastructure and resident real estate expert. These reports offer hyperlocal insights, providing a comprehensive view of market shifts within our boundaries. Get an insider’s perspective on industrial, office, retail, and multifamily trends specific to our area. Whether you’re an investor, developer, or business owner, our reports deliver key data on vacancy rates, market rents, and new developments—all tailored to the unique conditions of the North Houston District. We conduct these reports to empower stakeholders with the knowledge they need to make informed decisions in one of Houston’s fastest-evolving commercial hubs.

Why We Do These Reports: Our goal is to spotlight the unique dynamics shaping North Houston’s real estate market. By offering a hyperlocal view, we provide actionable insights that national or citywide reports might overlook. From logistics and industrial growth to resilient office spaces, we track it all, so you can stay ahead in an ever-changing landscape.

Q4 2024 North Houston Commercial Real Estate Market Report

Classic Supply and Demand

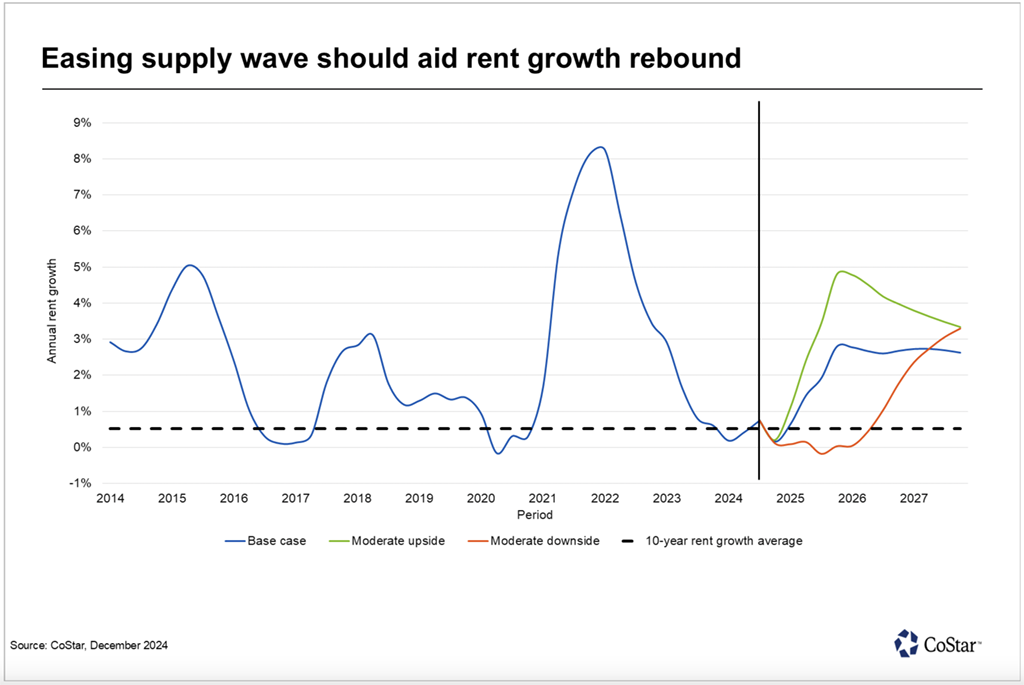

The main point is the classic principle of economics – supply and demand and its impact on prices. As we all know the principle is that as supply tightens and demand either stays strong or grows, prices rise. The first half is well underway both nationally and locally in the multifamily market and the latter, in the form of rent growth, is perhaps just around the corner.

Multifamily Starts Slowing

Nationally multifamily starts are at their lowest in over five years and have declined for 6 straight quarters going back to Q1 of 2023. Nowhere has this been more dramatic than in Houston.

Annual rent growth Bottomed Out

Nationally multifamily starts are at their lowest in over five years and have declined for 6 straight quarters going back to Q1 of 2023. Nowhere has this been more dramatic than in Houston.

Industrial/flex

Square Feet

Market Rent Per/sf

%

Vacancy Rate

%

Cap Rate

Office Class A

Square Feet

Market Rent Per/sf

%

Vacancy Rate

%

Cap Rate

Office Class B/C

Square Feet

Market Rent Per/sf

%

Vacancy Rate

%

Cap Rate

Retail

Square Feet

Market Rent Per/sf

%

Vacancy Rate

%

Cap Rate

Multi-Family

Square Feet

Market Rent Average

%

Vacancy Rate

%

Cap Rate

Recent Reports

Q3 2024 North Houston Commercial Real Estate Market Report

Q2 2024 North Houston Commercial Real Estate Market Report

Questions? Connect with us.

Robert Fiederlein

Vice President Planning and Infrastructure

Direct: 281-874-2132

Mobile: 713-816-5413

rfiederlein@northhouston.org